Bussiness

Kenya eyes Sh65bn foreign inflows on Europe, Asia economic upturn

Kenya is eyeing a growth of at least $503 million (Sh65.4 billion) in diaspora remittances this year compared to last year, riding on higher inflows from Europe and Asia as global economic prospects improve amid falling inflation.

The Central Bank of Kenya (CBK) is projecting a year-on-year growth of 12 percent in remittances this year, which would raise the total annual flow from $4.19 billion (Sh544.7 billion) in 2023 to $4.69 billion (Sh610 billion) in 2024.

This would be the fastest annual growth in remittances in percentage terms since 2021, when the volume of cash Kenyans abroad sent home rose by 20 percent to $3.72 billion (Sh483.6 billion) as global economic activity recovered as the Covid-19 pandemic was brought under control.

In 2023, the cash sent home grew by four percent, while the growth in 2022 stood at eight percent.

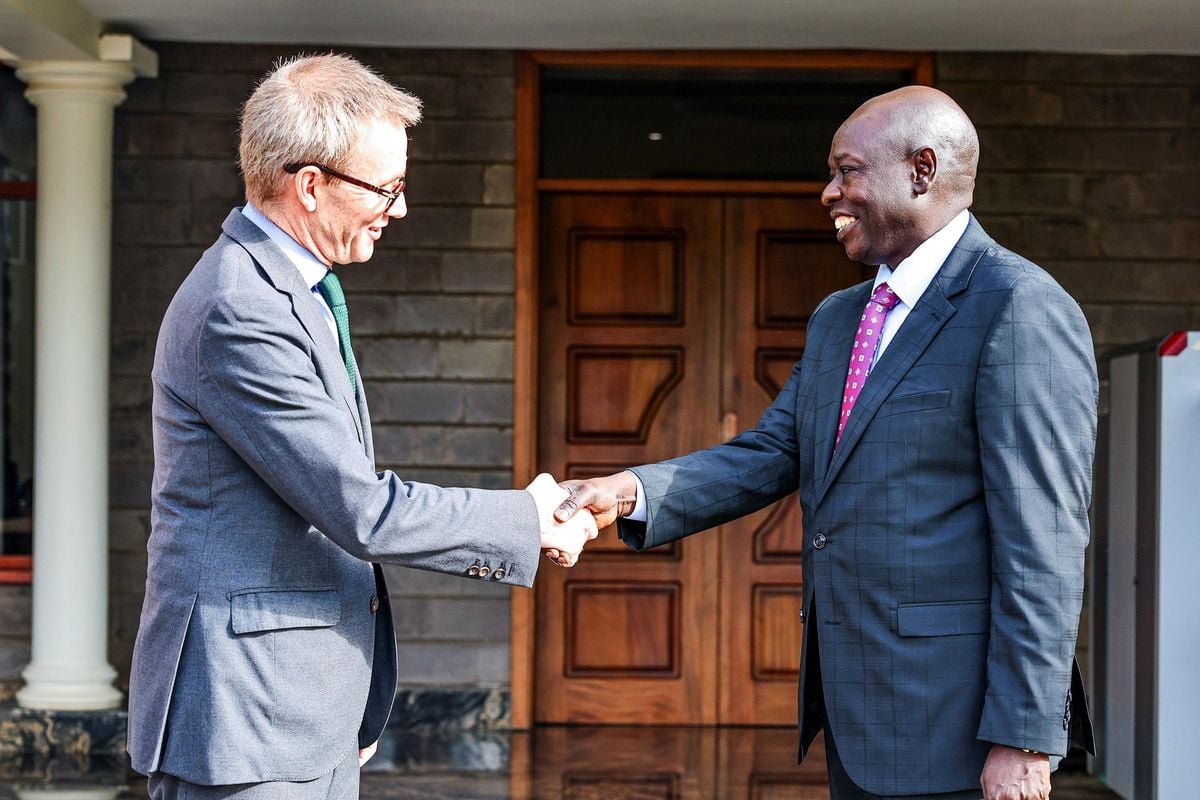

The projected 12 percent growth, according to CBK Governor Kamau Thugge, is a conservative estimate, meaning that the expansion in remittance volumes could even be higher if the pace of growth over the first four months of this year is maintained.

In the four months to April, remittances grew by 20 percent to $1.6 billion (Sh208 billion) compared to the corresponding period in 2023.

Should this pace of growth be maintained over the remaining eight months of the year however, the annual increase for 2024 would jump to $838 million (Sh109 billion), beating the previous record of $750 million (Sh97.5 billion at today’s rate) that was seen in 2018.

“We have revised our projections for growth in remittances [in 2024] from the previous five percent. Although so far this year they have grown by 20 percent, we have been fairly cautious in our balance of payments and we have assumed an increase of only 12 percent,” said Dr Thugge in a briefing on the Monetary Policy Committee meeting on Thursday.

“Therefore, there is likely the possibility of overperformance in the current account if we can get remittances to grow by 20 percent.”

Several factors have driven the faster growth in volumes this year, including lower inflation in key source markets such as the US and the UK, which has helped raise the volume of disposable income available to be sent abroad by workers in these countries.

The growth of the Middle East as a destination for Kenyan migrant labour has also boosted the volumes from the region, particularly Saudi Arabia which has since last year overtaken the UK as the second biggest source of remittance dollars for Kenya.

Sharp growth in remittances from other markets such as Australia, Germany, the UAE and Canada this year has also boosted the overall growth in volumes.

In the first four months of the year, volumes from Australia have gone up by 92.4 percent to $51 million (Sh6.63 billion), Canada by 82.8 percent to $40 million (Sh5.2 billion), UAE by 61 percent to $36 million (Sh4.7 billion) and Germany by 54 percent to $75 million (Sh9.8 billion).

Meanwhile, the US remittances rose by 8.5 percent to $840 million (Sh109.2 billion), Saudi Arabia by 16.7 percent to $138 million (Sh18 billion) and the UK by 27.6 percent to $131 million (Sh17 billion).

“The US continues to be the main source of remittances, but remittances are coming from many countries, so to that extent they are resilient…that is why we have been able to sustain the increase in volumes even when there is a slowdown in global economic growth,” added Dr Thugge.

Going forward, the anticipated rate cut in the US later this year has the potential to boost flows from the country, especially if Kenya maintains its attractive interest rates that can attract investors seeking better returns away from the US.

For Kenyans living abroad, participation in the local government securities market has also been made easier by the introduction of the CBK’s electronic bonds platform known as Dhow CSD.